Managing credit card debt effectively: tips for relief

Managing credit card debt effectively involves creating a budget, making more than the minimum payments, avoiding new debt, and considering professional advice to develop a solid repayment strategy.

Managing credit card debt effectively is crucial for maintaining financial stability. Many people find themselves overwhelmed by high-interest rates and monthly payments. But what if there are smart strategies to simplify this process?

Understanding credit card debt

Understanding credit card debt is the first step towards managing it effectively. Many consumers find it challenging to grasp how interest accumulates and how payments work. By gaining a clearer insight, you can make informed decisions that will benefit your financial health.

Credit card debt can accumulate quickly due to high interest rates. For instance, missing a payment can lead to hefty fees and increased interest rates. It’s essential to read the terms of your credit card agreement carefully. Not every credit card operates the same way, and understanding these nuances can save you money.

Types of credit card debt

There are mainly two types of credit card debt:

- Revolving debt: This is the most common type, where you can borrow up to a limit and pay it off over time.

- Installment debt: This involves making equal payments for a set duration until the debt is cleared.

- Cash advances: These typically come with higher interest rates and fees.

Knowing these types can help you strategize repayment options. Also, consider how your spending habits affect your debt. Tracking your expenses can make a significant difference in managing and reducing your debt effectively.

Debt can also impact your credit score, making it crucial to maintain a balance that is manageable. Regularly monitoring your credit report can provide insights on how your credit card usage affects your overall score. When you understand credit card debt, you can proactively address issues before they escalate.

Exploring these concepts not only empowers you but also equips you with tools necessary for financial literacy. Developing strategies to tackle credit card debt involves understanding its implications.

Practical tips for managing credit card repayments

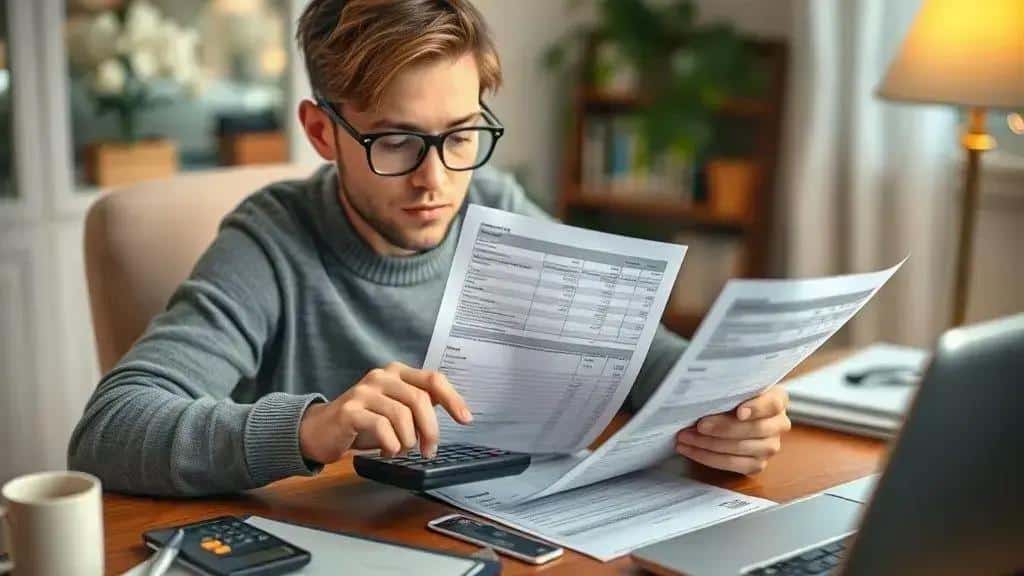

Managing credit card repayments can feel overwhelming, but with the right strategies, you can take control of your finances. Practical tips will help simplify this process and reduce stress.

One effective approach is to create a budget. Start by listing all your income and expenses. This allows you to see how much you can allocate towards credit card payments. Consistently sticking to a budget helps in prioritizing your debt repayments.

Set up automatic payments

Setting up automatic payments can prevent missed deadlines. Here are some tips:

- Choose the minimum payment to avoid late fees.

- Consider scheduling payments a few days before the due date.

- Set reminders for when your payments are processed.

Automatic payments ensure you never forget to pay, reducing the risk of additional charges. Another important strategy is to pay more than the minimum when possible.

Prioritize high-interest debts

Focusing on paying off high-interest debts first can save you money over time. You can use the following techniques:

- The avalanche method: Pay off debts with the highest interest rates first.

- The snowball method: Start with the smallest debts to build momentum.

Once high-interest debts are cleared, you’ll have more flexibility in your budget for other expenses. Additionally, consider transferring your balance to a card with a lower interest rate. This can be a strategic way to minimize the costs associated with debt.

Remember, it’s essential to avoid accumulating new debt while trying to manage existing repayments. This means being mindful of unnecessary purchases and using your credit cards wisely. Establishing and sticking to a plan is crucial in managing credit card repayments effectively.

Common pitfalls to avoid

Avoiding common pitfalls when managing your credit card debt is vital for achieving financial stability. Many people make mistakes that can lead to increased debt and financial stress. Being aware of these pitfalls can help you navigate your repayments more effectively.

One major pitfall is only making the minimum payments. While it may seem easier, this can lead to long-term debt accumulation due to high interest. Consider paying more than the minimum whenever possible. This approach not only reduces your principal faster but also saves you money in interest over time.

Ignoring interest rates

Another common mistake is ignoring the interest rates on your credit cards. Different cards can have varying rates that directly affect how much you owe. Keeping track of these rates will help you decide which debt should be prioritized for repayment:

- Pay off cards with the highest interest rates first.

- Consider transferring balances to lower-interest cards.

- Be cautious with introductory rates that may increase after a period.

Additionally, it’s important to resist the temptation of acquiring new debt. Using credit cards for non-essential purchases can quickly add to your overall debt load. Instead, focus on using cash or debit cards for everyday expenses to avoid blowing your budget.

Neglecting to track spending

Many people fail to track their spending, leading to unplanned purchases and rising debt. Setting a budget is crucial for understanding where your money goes each month. Make use of budgeting apps or simple spreadsheets to monitor your expenses. By keeping a watchful eye on your finances, you can limit unnecessary spending and prioritize credit card debt repayment.

Lastly, don’t ignore the importance of seeking help. If managing your debt feels overwhelming, consider talking to a financial advisor or a credit counseling service. They can provide valuable insights and strategies tailored to your financial situation. By avoiding these common pitfalls, you can make smarter choices and pave the way toward a debt-free future.

Creating a budgeting plan to overcome debt

Creating a budgeting plan is essential for overcoming debt, especially credit card debt. A strong budget helps you track your income and expenses, making it easier to allocate funds for debt repayment. This process can be simple but requires commitment and consistency.

Start by listing your total monthly income. Include all sources, such as your salary, freelance work, or any side jobs. Next, identify your fixed expenses, such as rent or mortgage, utilities, and insurance. These are costs that remain relatively constant every month.

Identify variable expenses

After outlining fixed costs, it is crucial to break down your variable expenses:

- Groceries

- Entertainment

- Transportation

- Dining out

Tracking these expenses can reveal areas where you can cut back. For instance, reducing dining out or canceling unnecessary subscriptions can free up funds for debt repayment.

Set financial goals

Setting specific financial goals is a fundamental part of creating your budget. Think about how much you want to put toward paying off your credit card debt each month. Having clear goals will motivate you to stick to your budget.

Consider questions like:

- Do I want to pay off all my credit cards within a year?

- Can I allocate extra funds from bonuses or tax returns toward debt?

Additionally, create a savings plan. Emergencies can arise, and having a savings cushion means you won’t need to rely on credit cards for unexpected expenses. Set aside a small portion of your income monthly to build this fund.

Once your budget is in place, be sure to regularly review and adjust it as necessary. Life changes, and your budget should reflect that. Keeping track of your progress will not only help you stay on track with your credit card debt but all aspects of your financial health.

FAQ – Frequently Asked Questions about Managing Credit Card Debt

What are the first steps to manage credit card debt effectively?

Start by creating a budget to track your income and expenses, then identify your total debt and prioritize repayments.

How can I avoid accumulating new debt while paying off existing debt?

Use cash or debit cards for daily expenses instead of credit cards, and limit unnecessary purchases.

What should I do if I can’t make the minimum payment on my credit card?

Contact your credit card issuer to discuss your options, which may include setting up a payment plan or hardship plan.

Is it helpful to seek professional advice for managing credit card debt?

Yes, financial advisors or credit counseling services can provide personalized strategies and support for effective debt management.