Student Loan Forgiveness 2026: Federal Programs & Eligibility

Federal initiatives for student loan forgiveness in 2026 are designed to alleviate financial burdens, offering various pathways for borrowers to reduce or eliminate their educational debt based on specific eligibility criteria and program types.

Navigating the complex landscape of student debt can feel overwhelming, but for many, relief is within reach. Understanding the various student loan forgiveness programs in 2026 is more crucial than ever as new federal initiatives continue to evolve. This article will guide you through the latest programs, eligibility requirements, and application processes, helping you determine if you qualify for significant debt relief.

Understanding the Current Landscape of Student Loan Forgiveness in 2026

The year 2026 brings both continuity and new developments in federal student loan forgiveness. It’s a dynamic environment, shaped by ongoing policy adjustments and economic considerations. Borrowers must stay informed about these changes to take full advantage of available relief options.

Federal programs aim to support different segments of the population, from public servants to individuals facing economic hardship. These initiatives reflect a broader commitment to making higher education more affordable and manageable in the long term.

Key Federal Forgiveness Programs

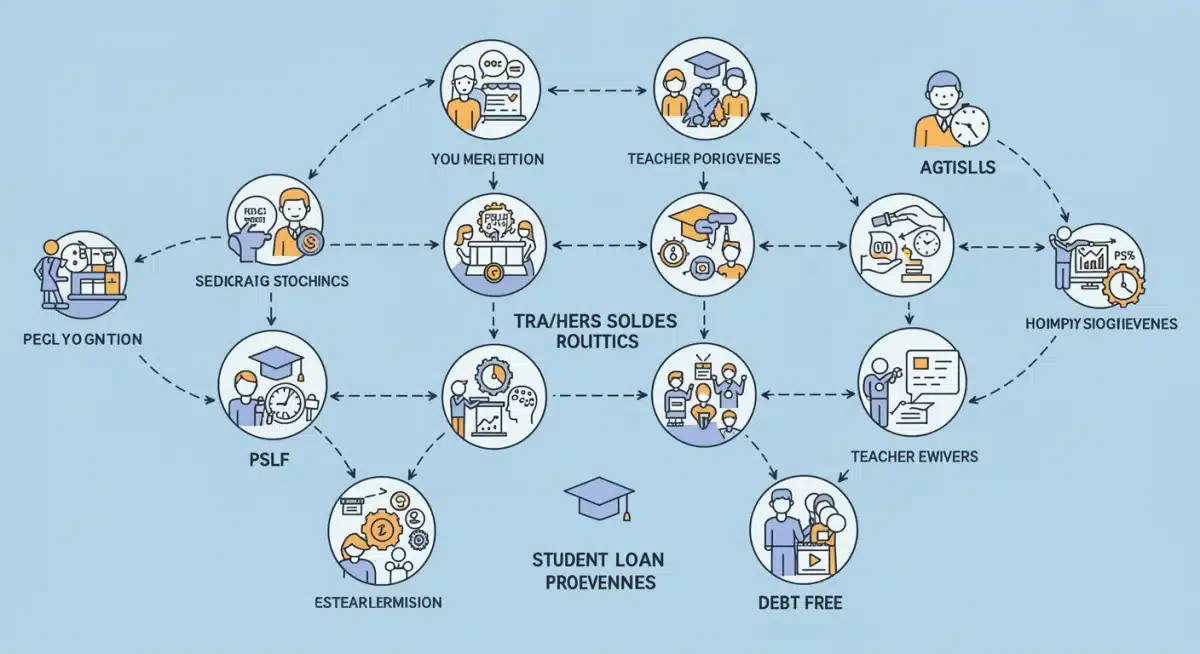

Several cornerstone programs continue to be central to federal student loan forgiveness efforts. Each program has distinct requirements and benefits, catering to different borrower circumstances.

- Public Service Loan Forgiveness (PSLF): Designed for individuals working full-time for qualifying non-profit organizations or government agencies.

- Income-Driven Repayment (IDR) Plan Forgiveness: Offers forgiveness of remaining loan balances after 20 or 25 years of payments under an IDR plan.

- Teacher Loan Forgiveness: Provides relief for teachers who work for five consecutive years in low-income schools or educational service agencies.

Understanding the nuances of each program is the first step toward determining your potential eligibility. Many borrowers may qualify for more than one program, so a thorough review is essential.

Public Service Loan Forgiveness (PSLF): Eligibility and Updates for 2026

The Public Service Loan Forgiveness (PSLF) program remains a vital pathway for many to achieve freedom from student loan debt. In 2026, the core principles of PSLF persist, but there are ongoing efforts to streamline the process and clarify eligibility, reflecting lessons learned from previous years.

PSLF is specifically tailored for individuals dedicated to public service. This includes a wide range of professions that contribute to the public good, emphasizing the government’s commitment to supporting those who choose these careers.

Who Qualifies for PSLF?

To be eligible for PSLF, borrowers must meet specific criteria related to their employment, loan type, and payment history. These requirements are strictly enforced to ensure the program benefits its intended recipients.

- Qualifying Employment: You must be employed full-time by a U.S. federal, state, local, or tribal government organization or a qualifying non-profit organization.

- Loan Type: Only Direct Loans are eligible. If you have other federal loan types, you may need to consolidate them into a Direct Consolidation Loan.

- Qualifying Payments: You must make 120 qualifying monthly payments under a qualifying repayment plan while working for a qualifying employer.

It is crucial to track your employment and payments meticulously. Many past applicants encountered issues due to insufficient documentation or misunderstandings of the rules. The Department of Education continues to refine its tools and guidance to assist borrowers.

Optimizing Your PSLF Journey in 2026

For those pursuing PSLF, proactive management is key. This involves regular communication with your loan servicer and utilizing available resources. The goal is to ensure every payment and every year of service counts towards your forgiveness.

Regularly submitting the PSLF Employment Certification Form is highly recommended. This allows the Department of Education to track your progress and notify you of any issues early on, preventing surprises when you apply for forgiveness after ten years. Staying informed about any legislative or administrative changes is also vital, as policies can evolve even within a few years.

Income-Driven Repayment (IDR) Plans and Forgiveness in 2026

Income-Driven Repayment (IDR) plans provide a safety net for borrowers whose incomes are low relative to their student loan debt. In 2026, these plans continue to offer manageable monthly payments and the promise of forgiveness after a specified period, typically 20 or 25 years.

The core concept behind IDR plans is to adjust your monthly payment based on your income and family size, ensuring that payments are affordable. Any remaining balance is forgiven after the repayment period, though this forgiven amount may be considered taxable income.

Types of IDR Plans and Their Forgiveness Terms

Several IDR plans are available, each with slightly different terms regarding payment calculations and forgiveness timelines. Understanding these differences helps borrowers choose the most suitable plan.

- SAVE Plan (formerly REPAYE): Generally offers the lowest monthly payments, often capping them at 10% of discretionary income, with forgiveness after 20 or 25 years.

- Pay As You Earn (PAYE) Repayment Plan: Payments are capped at 10% of discretionary income, with forgiveness after 20 years.

- Income-Based Repayment (IBR) Plan: Payments are typically 10% or 15% of discretionary income, with forgiveness after 20 or 25 years.

It’s important to recertify your income and family size annually to ensure your payments remain accurate and you stay on track for forgiveness. Missing recertification can lead to higher payments and a loss of capitalized interest benefits.

Maximizing IDR Benefits for Forgiveness

To maximize your chances of forgiveness under an IDR plan, consistent enrollment and annual recertification are non-negotiable. Any periods of non-payment or incorrect payment amounts can delay your progress towards the forgiveness date.

Borrowers should also be aware of potential tax implications of IDR forgiveness. While the federal government has sometimes offered temporary tax exemptions for forgiven amounts, this is not always the case, and it’s wise to consult a tax professional as you approach your forgiveness eligibility date in 2026.

Teacher Loan Forgiveness and Other Profession-Specific Programs

Beyond PSLF, several other federal programs target specific professions, recognizing the vital contributions of individuals in these fields. Teachers, in particular, have dedicated avenues for student loan relief that remain active in 2026.

These programs aim to incentivize individuals to enter and remain in critical professions, especially in underserved areas. They offer a direct financial benefit that can significantly reduce the burden of educational debt.

Teacher Loan Forgiveness Details

The Teacher Loan Forgiveness program offers up to $17,500 in forgiveness for eligible teachers. This program is distinct from PSLF, with different requirements and a shorter service commitment.

- Qualifying Service: You must teach full-time for five complete and consecutive academic years in a low-income school or educational service agency.

- Loan Eligibility: Only Direct Subsidized and Unsubsidized Loans and Federal Stafford Loans are eligible. Perkins Loans are not.

- Forgiveness Amount: Up to $17,500 for highly qualified math, science, or special education teachers, and up to $5,000 for other eligible teachers.

It’s important to note that you cannot receive both Teacher Loan Forgiveness and PSLF for the same period of service. Borrowers must strategically choose the program that offers them the most benefit.

Other Professional Forgiveness Programs

While teacher loan forgiveness is prominent, other professions may also qualify for specific relief. These often include healthcare professionals working in underserved communities or researchers in critical fields. These programs are typically smaller in scale but can provide significant relief for those who qualify.

Examples include the National Health Service Corps (NHSC) Loan Repayment Program for health professionals and certain state-specific programs. Always research options relevant to your profession and location, as new initiatives or expanded funding can emerge in 2026.

Navigating the Application Process and Avoiding Pitfalls

Applying for student loan forgiveness can be complex, and understanding the process is essential to avoid common pitfalls that could delay or even prevent your relief. In 2026, clarity and diligence remain paramount for successful applications.

The application journey requires attention to detail, accurate record-keeping, and sometimes, persistence. Many borrowers face challenges with documentation or understanding specific program requirements, highlighting the need for careful preparation.

Key Steps for a Successful Application

Regardless of the specific forgiveness program, there are general steps that borrowers should follow to ensure a smooth application process. These steps help to organize your information and meet deadlines effectively.

- Gather Documentation: Collect all necessary employment verification, payment records, and loan statements.

- Complete Application Forms Accurately: Double-check all information before submission. Errors can lead to delays.

- Submit on Time: Be aware of any deadlines for applications or recertifications.

- Follow Up: Don’t assume your application is progressing smoothly. Follow up with your loan servicer regularly.

One common pitfall is relying solely on verbal information. Always seek written confirmation of any advice or decisions from your loan servicer or the Department of Education. This provides a paper trail in case of discrepancies.

Common Pitfalls to Avoid

Many borrowers encounter issues that could have been prevented with careful planning. These often revolve around misunderstandings of program rules or insufficient record-keeping.

Forgetting to recertify income for IDR plans, not consolidating ineligible loans into Direct Loans, or failing to verify employer eligibility for PSLF are frequent mistakes. Proactive engagement with your loan servicer and utilizing online tools provided by the Department of Education can help mitigate these risks. Staying informed about any changes in federal policy is also crucial, as program rules can evolve over time, impacting eligibility or application requirements.

Future Outlook: Potential Changes and Advocacy for 2026

While we focus on the existing student loan forgiveness programs in 2026, it’s also important to consider the dynamic nature of federal policy. The landscape of student debt relief is subject to ongoing debate and potential reforms, which could introduce new opportunities or modify current programs.

Advocacy groups and policymakers continue to explore various solutions to address the broader issue of student loan debt. These discussions often involve proposals for broader forgiveness, adjustments to interest rates, or reforms to the higher education financing system itself.

Anticipated Policy Discussions

Several areas of potential change are frequently discussed. These could influence the availability and scope of forgiveness programs beyond what is currently in place.

- Broader Forgiveness Initiatives: Debates continue regarding the potential for widespread student loan forgiveness, though the specifics and likelihood remain uncertain.

- Program Simplification: Efforts to simplify the application and management of existing forgiveness programs are ongoing to reduce administrative burdens for borrowers.

- Targeted Relief Expansion: There’s always a possibility of expanding relief for specific groups, such as those with disabilities or in critical low-wage professions.

Borrowers should monitor news from the Department of Education and legislative bodies for updates. Remaining informed ensures you can adapt your strategy if new programs become available or existing ones are modified.

The Role of Advocacy and Information

Advocacy plays a significant role in shaping future student loan policies. Organizations dedicated to student debt relief continuously push for reforms that benefit borrowers. Engaging with these resources can provide valuable insights and keep you abreast of potential changes.

Platforms like NewsHealthConnects.com strive to provide timely and accurate information on these evolving topics. Staying connected to reliable news sources and official government announcements is the best way to prepare for any future shifts in student loan forgiveness policies.

Resources and Tools for Managing Your Student Loans in 2026

Managing student loans effectively requires access to reliable information and practical tools. In 2026, numerous resources are available to help borrowers understand their options, track their loans, and navigate the path to forgiveness or repayment.

The Department of Education and various non-profit organizations offer a wealth of guidance, from detailed program descriptions to calculators and direct assistance. Utilizing these resources can make a significant difference in your financial journey.

Official Federal Resources

The most authoritative source of information for federal student loans is the U.S. Department of Education. Their official websites provide comprehensive details on all federal programs.

- StudentAid.gov: This portal is your primary resource for managing federal student aid, including loan details, repayment options, and forgiveness program information.

- Loan Servicer Websites: Your specific loan servicer (e.g., Nelnet, MOHELA) will have a portal where you can view your loan balance, payment history, and submit applications.

- Federal Student Aid Information Center: Provides direct support and answers to common questions about federal student loans.

Always verify information with official sources to ensure accuracy. Social media and unofficial forums can be helpful for peer support but should not be the sole basis for financial decisions.

Financial Planning and Advisory Services

For complex situations or personalized advice, consulting with a financial advisor specializing in student loan debt can be highly beneficial. These professionals can help you understand the intricacies of various programs and develop a tailored strategy.

Many non-profit credit counseling agencies also offer free or low-cost services to help borrowers manage their debt. They can provide guidance on budgeting, repayment strategies, and understanding eligibility for forgiveness programs. A comprehensive approach, combining self-education with expert advice, offers the best chance for successful student loan management.

| Program Type | Brief Description |

|---|---|

| PSLF | Forgiveness for public service workers after 120 qualifying payments. |

| IDR Forgiveness | Remaining balances forgiven after 20-25 years of income-driven payments. |

| Teacher Loan Forgiveness | Up to $17,500 for teachers in low-income schools after 5 years of service. |

| General Eligibility | Requirements vary by program, often including loan type, employment, and payment history. |

Frequently Asked Questions About Student Loan Forgiveness in 2026

The main federal programs in 2026 include Public Service Loan Forgiveness (PSLF), various Income-Driven Repayment (IDR) plans leading to forgiveness, and Teacher Loan Forgiveness. Each program targets specific borrower circumstances and has distinct eligibility criteria to qualify for debt relief.

Your employment qualifies for PSLF if you work full-time for a U.S. federal, state, local, or tribal government organization, or a qualifying non-profit organization. It’s crucial to submit the PSLF Employment Certification Form regularly to confirm eligibility and track your progress effectively.

Generally, student loan amounts forgiven under PSLF are not considered taxable income. However, forgiveness under Income-Driven Repayment plans may be taxable unless Congress extends temporary tax exemptions. Consulting a tax professional is highly recommended to understand your specific tax situation.

Key steps include gathering all necessary documentation (employment verification, payment records), accurately completing the specific application forms for your chosen program, and submitting them on time. Regular follow-up with your loan servicer is also essential to ensure your application progresses smoothly and to address any issues promptly.

While you might meet the criteria for multiple programs, you can typically only receive forgiveness from one for the same period of service or payments. It’s important to evaluate which program offers the most significant benefit for your unique circumstances and strategically choose your path to maximize relief.

Conclusion

The availability of student loan forgiveness programs in 2026 offers a beacon of hope for many struggling with educational debt. Understanding the intricate details of programs like PSLF, IDR forgiveness, and Teacher Loan Forgiveness is not just about identifying eligibility; it’s about empowering yourself with knowledge to make informed financial decisions. By staying informed, meticulously managing your documentation, and utilizing available federal resources, you can navigate the path to debt relief effectively. The federal government continues its commitment to supporting borrowers, and with careful planning, a significant reduction in your student loan burden is an achievable goal.